The better way to borrow.

Welcome to the home of Guarantor Loans.

Affordable repayments

No Fees

Choose your loan amount:

Representative 49.9% APR (variable)

Representative Example: Borrowing £4,000 over 36 months, repaying £195.16 per month, total repayable £7025.76. Interest rate 49.9% (variable). Subject to status.

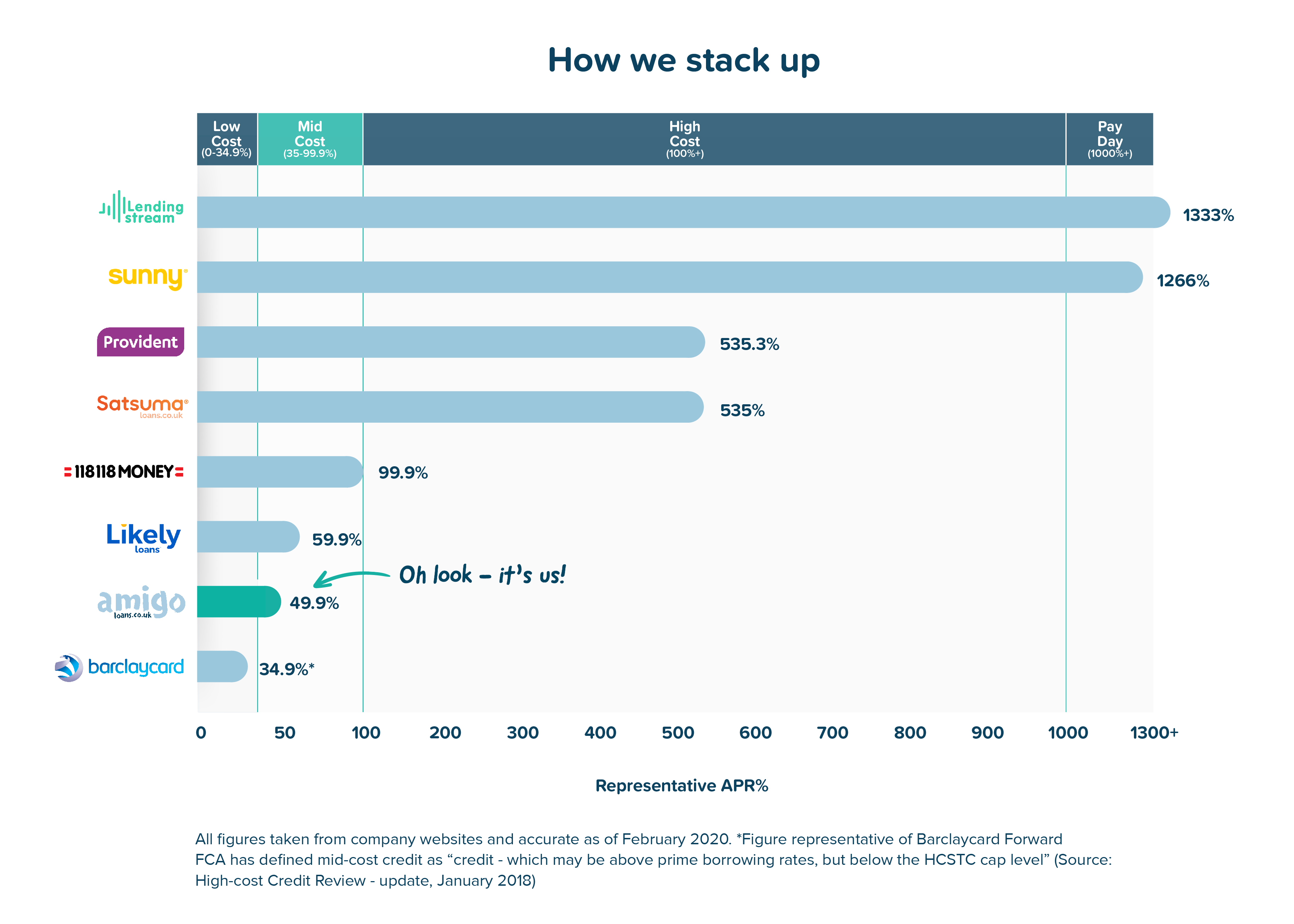

You want the best deal, right?

So, let's talk numbers. Here's how we size up against the rest...

The next best thing to banks

Our flexible guarantor loans are around a 30th of the APR of a payday loan and when you compare us to what else is out there, we are one of the best options for anyone borrowing up to £10,000 with a not so perfect credit score. So, if you've been turned down by a bank, we could help you get the money you need.

Why a guarantor loan could be your best option

Here at Amigo, we base our loans on friendship and trust and not ‘perfect’ credit scores. If you have someone who trusts you and is willing to be your guarantor, then we could help you.

A guarantor is someone who trusts you to make the payments, and is happy to pay for any if you don't. They're usually a good friend or family member. If they have the confidence in you to make the repayments, then we will too.

Here's how Amigo makes borrowing simple:

Our application takes minutes to complete.

We NEVER charge fees.

We allow you to spread your loan over a term to suit you and your affordability.

We could still accept you even if you have a bad credit score.

Award winning for a reason

We don't want to blow our own trumpet too much (okay, maybe we do a little), but we are proud winners of these awards.

Do you have a question?

Top 10 Questions

- How do I make a payment or settle my loan?

- How do I change my payment date?

- Why was my guarantor declined?

- Can I make a late payment?

- How long does it take to get my loan?

- How do I log in?

- Can the loan be paid off early?

- Our application process explained

- Can I get a loan without a guarantor?

- How does the interest work and can I make extra payments?