Confused by your credit file?

You’re not the only one

Your credit file

First things first, a very quick overview of what your credit file actually is.

Your credit file is a record of your financial commitments (credit cards, loans, even bank accounts). Every time you make a payment on time to one of these creditors, this gets recorded on your credit file. If a payment is late, or is not paid at all, this gets recorded as well. All this information (payments, late payments, as well as a lot of other stuff) then gets put together and comes out as a credit score.

Many lenders, such as banks, use your credit score to decide if it’s a risk lending to you. Basically, whether they think they’ll get their money back. The lower your score, the less likely they’ll be to trust you.

So what does this mean for Amigo Loans? Well, we do things slightly differently.

Credit Checks

Will Amigo Loans credit check me?

Taking on a loan can be a big commitment, so it’s important we take into account your financial situation when making a decision.

We do this by asking you to complete an online budget plan and by carrying out a credit check - but don’t worry, we aren’t looking for a perfect credit score!

As a responsible lender, we simply look at how you’ve managed certain items of credit to help us understand if the repayments of the Amigo loan could put you into financial difficulty or not.

Will Amigo Loans credit check the guarantor?

We credit check the guarantor differently to the borrower because the criteria for our guarantors is slightly different. We check they’re financially stable and haven’t had trouble paying back their bills in the past, which lets us know the responsibility of standing guarantor is right for them.

This is done with a quotation search, also known as a soft search. But don’t worry, these types of credit checks are invisible to other creditors and won’t affect the guarantor’s credit score. The only person that will be aware of the credit check is the guarantor themselves.

Will the loan appear on the guarantor’s credit file?

Our loans don’t appear on the guarantor’s credit file. The loan was taken out for the borrower, not the guarantor, so this is what gets fed back to the credit reference agencies. In fact, there’ll be nothing on their credit file to show they’re a guarantor at all.

The only time an Amigo loan could affect a guarantor’s credit file or credit score is if there’s no arrangement in place to maintain the loan and any arrears become unmanageable. If this happened, we may need to take court action (don’t worry, we always aim to avoid this as much as possible). Where the court judges that the borrower or guarantor must pay and they still refuse, the judge will record this judgement on their credit file after 28 days. This is called a County Court Judgment (CCJ).

Credit Scores

How does my loan affect my credit score?

How you maintain your loan (whether you make payments on time or not) is the main thing that will affect your credit score.

Every time you make a payment on time, a positive marker goes to the credit reference agencies (Equifax, TransUnion and Experian). The more payments you make on time and in full, the better your credit history could become.

This is good if you’ve got bad credit or no credit history. As long as you keep on top of your other bills and financial commitments as well, your credit score could begin to rise.

Don’t believe us? We’ve won the Best Credit Builder award from Moneynet for six years running!

Moneynet Award 2019

Best Credit Builder Product

Just so you know, if you miss a payment, we need to let the credit reference agencies know about this too. This is recorded as a missed payment and could make your credit history worse and make obtaining credit in the future more difficult. It’s important you keep on top of your payments and let us know if you may be struggling.

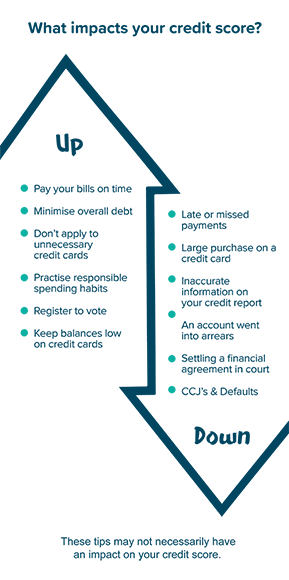

How can I improve my credit score?

The best way to improve your credit score is simply to keep up-to-date with all your payments. Not just your Amigo loan, but all your other financial commitments as well.

That being said, there are a number of other factors that could affect your credit score too.

While none of these are guaranteed to affect your credit score, the credit reference agencies take all this into account.

So that’s your credit file explained. Simple.

If we've inspired you to look further into your credit file, there's a few sites such as Credit Karma, ClearScore and Experian where you can sign up for a free account and check your credit report any time you like.

Anything we haven't covered?

Check out our guides below: